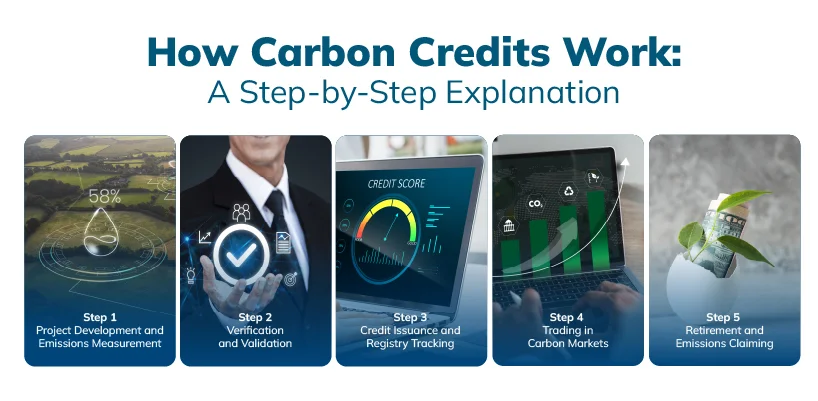

Carbon credits work through a market based mechanism that incentivizes projects reducing or removing greenhouse gas emissions. Verified projects generate credits that enter registries, where they can be traded in carbon credit markets. Once purchased, credits are retired through a controlled process to offset unavoidable emissions while maintaining transparency, auditability, and environmental integrity.

Read this blog to understand the step by step mechanism behind how carbon credits work and the relevance behind each step.

Overview of the Carbon Credit Process

The carbon credit lifecycle follows a defined flow rather than a theoretical model. Emissions reductions are created at the project level, verified against approved rules, and issued into registries. From there, credits move through carbon credit markets to organizations that need them for emissions management. This system allows emissions reductions to be applied where they are needed most, across both compliance obligations and voluntary sustainability use cases.

Step 1 – Project Development and Emissions Measurement

Carbon credits begin with projects designed to reduce, avoid or remove greenhouse gas emissions. These projects form the foundation of how carbon credits work and determine whether credits can enter the carbon credit lifecycle.

What qualifies as a carbon credit project?

- Projects must not be “business-as-usual”.

- Projects must deliver measurable emissions reductions or removals

- Activities must follow approved scientific methodologies

- Emissions outcomes must be attributable to the project itself

Establishing baseline emissions

- Baseline emissions represent expected emissions without the project

- Reductions are calculated by comparing actual emissions to this baseline

- Accurate baselines are critical for carbon credit verification

Monitoring and data integrity

- Continuous monitoring tracks emissions performance

- Data accuracy supports audit and reporting requirements

- Traceability strengthens confidence in carbon credit markets

Mobility and industrial examples include renewable electricity with storage for manufacturing plants and methane capture from transport related waste systems.

Step 2 – Verification and Validation

Carbon credit verification ensures emissions reductions are real, additional, and measurable. Independent oversight protects market integrity and reduces greenwashing risk.

Role of independent verification bodies

Independent auditors review project design, emissions data, and monitoring systems. Their role is to confirm that reported reductions follow approved methodologies and scientific standards.

Why do verification principles matter?

Additionality, permanence, and leakage determine whether climate benefits are credible. These principles ensure that projects contribute genuine emissions reductions rather than reallocating emissions elsewhere.

Verification quality framework:

| Verification Criterion | What It Ensures |

| Additionality | Emission reductions would not occur otherwise |

| Permanence | Long term climate benefit |

| Leakage | No indirect emission increase |

| Monitoring | Ongoing measurement accuracy |

| Independent audit | Objective validation |

Step 3 – Credit Issuance and Registry Tracking

After verification is complete, carbon credits move from project status into formal accounting systems. This stage connects verified emission reductions to market use and ensures transparency across the carbon credit lifecycle.

Credit issuance

Once a project passes carbon credit verification, the verified emission reductions are converted into carbon credits. These credits are formally issued only after all validation checks are complete, ensuring that no credit enters the system without independent review.

Registry based tracking

Issued carbon credits are recorded in registries that assign unique serial identifiers. These identifiers track ownership, transfers, and final use over time. Registry tracking prevents double counting and allows credits to move reliably from projects to buyers within carbon credit markets.

Readers unfamiliar with core concepts may find background context helpful through What Are Carbon Credits.

Step 4 – Trading in Carbon Markets

Trading is the stage where carbon credits move between stakeholders with different roles in the emissions system. Project developers supply verified credits after issuance, intermediaries facilitate price discovery and transfers, and buyers acquire credits to meet regulatory or voluntary emissions objectives.

Compliance and voluntary market comparison

| Aspect | Compliance Market | Voluntary Market |

| Participation | Required by law for covered entities | Chosen by organizations and individuals |

| Typical buyers | Power producers, manufacturers, and regulated industrial emitters | Corporates, financial institutions, and value chain participants |

| Seller profile | Projects approved under regulatory schemes | Projects registered under voluntary standards |

| Pricing drivers | Emissions caps, allowance supply, and policy design | Project quality, demand signals, and buyer preferences |

| Objective | Meeting legal emission limits | Managing emissions beyond regulation |

Step 5 – Retirement and Emissions Claiming

Retirement marks the final stage of the carbon credit lifecycle. Once retired, a credit is permanently removed from circulation.

What retirement means in practice

- Credits cannot be reused or transferred

- Retirement records support emissions claims

- Registries lock retired credits permanently

Audit and reporting implications

Retirement data underpins sustainability disclosures and regulatory reporting. Clear retirement records reduce disputes and support verification during audits. This step completes how carbon credits work from creation to claim.

How Mobility and Industrial Organizations Use This Process in Practice?

Organizations across sectors engage with the carbon offset process in different ways, depending on where emissions occur and how much control they have over them. While the underlying carbon credit lifecycle remains the same, the purpose and timing of credit use varies by stakeholder role, regulatory exposure, and supply chain structure.

Automobile manufacturers

Automobile manufacturers manage emissions across raw material sourcing, component manufacturing, vehicle assembly, logistics, and end of life treatment. A significant share of these emissions fall under Scope 3, where direct control is limited.

Carbon credits are used to address emissions that cannot be reduced immediately while supplier transition programs and circular economy systems develop. This includes emissions linked to vehicle scrappage and material recovery, where structured mechanisms such as elv carbon credits connect recycling outcomes with verified emission reductions.

Logistics and aviation operators

Logistics and aviation organizations face high Scope 1 emissions from fuel use, with limited short term alternatives. Fleet renewal and fuel transitions take time and involve infrastructure constraints.

Carbon credits allow these operators to manage current emissions while investing in efficiency improvements, route optimization, and lower carbon fuel options. Credits are typically applied as an interim measure rather than a substitute for operational change.

Oil, energy, and shipping companies

For oil, energy, and shipping companies, a large share of emissions occurs downstream across transport, distribution, and customer use. Material recovery, waste handling, and logistics driven emissions are difficult to eliminate quickly. Carbon credits support accountability for these emissions during supply chain transitions and are often used alongside reporting on downstream and value chain emissions.

Financial institutions

Financial institutions engage with carbon credits primarily through financed emissions. Emissions linked to lending and investment portfolios cannot be reduced directly by operational changes. Verified carbon credits support emissions accounting, ESG disclosures, and climate risk management while institutions adjust portfolio strategies and engage with clients on decarbonization pathways.

Industrial enterprises

Industrial enterprises face process emissions, legacy equipment, and long asset lifecycles that limit immediate decarbonization. Carbon credits are used to bridge gaps between current operational realities and long term net zero targets. They support structured transition planning while investments in technology upgrades and process redesign are implemented.

How Organizations Can Digitally Manage the Carbon Credit Lifecycle and How MMCM Supports This?

Managing carbon credits requires systems that connect verification, ownership, and reporting across partners. Manual tracking increases the risk of errors and double counting.

Digital lifecycle management needs

- End to end traceability across registries

- Ownership and retirement tracking

- Audit documentation readiness

- Supplier and partner data integration

- ESG and regulatory reporting alignment

- Greenwashing risk mitigation

Platforms such as MMCM support digital management by centralizing lifecycle data, improving traceability across mobility value chains, and strengthening audit readiness across Scope 1 Scope 2 and Scope three workflows. This approach aligns with an end-to-end solution for rvsf that connects emissions data with operational outcomes.

Conclusion

Carbon credits move through a defined lifecycle that starts with project level emissions measurement and ends with formal retirement. Along the way, carbon credit verification confirms that reductions are real, registries record ownership and transfers, and retirement ensures credits cannot be reused. These controls protect integrity and allow credits to be applied with confidence.

For organizations managing Scope 1, Scope 2 and Scope 3 emissions, this process supports emissions accounting when direct reductions take time. Mobility, logistics, finance, and industrial sectors rely on this system to manage transition periods responsibly.

FAQ

The time required depends on project type, monitoring period, and verification requirements. Some projects issue carbon credits within several months, while others require multiple years of data collection. Projects involving long term storage or land use typically take longer due to extended monitoring and validation cycles.

Carbon credit projects are verified by independent third party verification bodies accredited under recognized standards. These auditors assess project design, emissions calculations, monitoring data, and compliance with approved methodologies. Verification ensures reported emissions reductions are real, measurable, and consistent with scientific and regulatory requirements.

If a project fails verification, carbon credits are not issued. The project developer may correct data gaps, revise methodologies, or improve monitoring systems and request re verification. If issues cannot be resolved, the project remains ineligible and its emissions reductions cannot be claimed.

Yes, carbon credits are commonly traded across borders through recognized registries and market platforms. International trading depends on registry acceptance, applicable regulations, and buyer requirements. Some compliance systems restrict cross border use, while voluntary markets generally allow

Double counting is prevented through registry based tracking systems that assign unique serial numbers to each carbon credit. Registries record issuance, transfers, and retirement. Once a credit is retired, it cannot be reused or transferred, ensuring the same emissions reduction is not claimed more than once.

Compliance markets are established by regulation and require covered entities to meet legal emissions limits. Voluntary markets allow organizations to purchase carbon credits by choice to support sustainability goals. Both use similar verification and registry systems, but participation and pricing drivers differ.

A carbon credit should be retired when an organization applies it against reported emissions for a specific period. Retirement confirms the emissions claim and prevents further trading. Timing usually aligns with sustainability reporting cycles, audits, or regulatory compliance deadlines.

No, a carbon credit can only be used once. After retirement, the credit is permanently removed from the registry and cannot be transferred or reused. This rule ensures emissions reductions are not claimed by multiple organizations.

Organizations track ownership through registry accounts that record issuance, transfers, and retirement. Each credit has a unique serial identifier. Transaction records and registry statements provide audit ready evidence of ownership and usage across reporting periods.

Yes, carbon credits are commonly used to manage Scope three emissions that occur outside direct operational control. These include supplier, logistics, and end of life emissions. Credits support emissions accounting while organizations work on long term supply chain decarbonization efforts.